CI – Dissemination

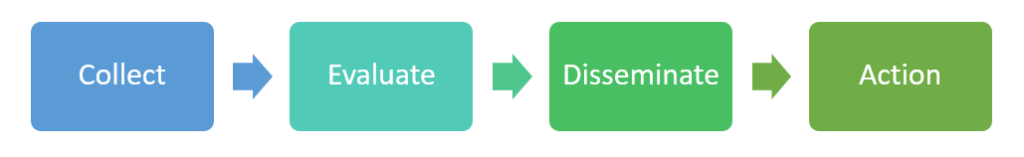

In an earlier post, I introduced the four-step model for competitive intelligence:

And then in a subsequent post, I described the first step – Collection.

The second step, Evaluation, is perhaps the most complex and therefore I am going to address it in an upcoming post in order to do the topic the justice that it deserves. For now, I am going to focus on the third step – Dissemination. In other words, communicating the intelligence to your stakeholders.

This is definitely a case of one size does not fit all.

You must create a communication plan that matches the needs of each stakeholder group. The content, timing, and method of communication for each group will vary

Therefore, you should meet with each team to discuss their needs and agree on an appropriate strategy with them.

When executing your plan, this is a good opportunity to build your credibility and reputation within your company and as part of that, I recommend creating a Competitive Intelligence brand for yourself by using a consistent, distinctive style to your communication. If your marketing team allows it, you could have your own logo which should be consistent with the rest of the company’s branding but stand out from it. Use this logo in all your emails, presentations, and reports.

Breaking News

As well as the approaches discussed for each group of stakeholders discussed below, you should also be prepared to handle ‘breaking news’ – significant competitive events that need to be communicated quickly so that they can be acted upon. However, don’t be tempted to simply forward a link to a news story to everyone on your internal email list, hoping to impress them with the speed of your action. You must add some analysis and I would suggest a two-step approach:

- To get the news out as quickly as possible, add your thoughts on the impact of the news on your stakeholders.

- And then follow up a few days later once you have been able to gather further insights from industry analysts and others that may be commenting on the news.

Sales Team

A salesperson needs tactical Competitive Intelligence to use when they are in the middle of a deal and they learn that a particular competitor is also in the opportunity. Therefore your primary goal for the sales team is to provide ‘always there’ access to the latest competitive intelligence. This will typically be in the form of dynamic sales battlecards easily accessible via an online Competitive Intelligence tool, or through the company’s Intranet or CRM system.

Whilst battlecards are the primary delivery tool for the sales team, they should not be the only ones.

Sales should be included in a regular (probably monthly) Competitive Intelligence update email or newsletter that summarises the key competitive developments in the most recent period. This is a good way for sales to learn about new entrants to the market and major campaigns that competitors are launching etc. It would be wise to attend sales meetings on a quarterly basis, not just to communicate to the team, but as an opportunity to interact with them and get feedback.

Executives

Your executive team will have very different needs from the sales team, and your communications plan must reflect that. They will not spend time looking at battlecards and are unlikely to pay much attention to regular emails or newsletters – although some ‘breaking news’ items such as the merger of two competitors will be highly relevant (as long as you provide some analysis – executives are likely to have their own sources and will almost certainly be aware of the big stories as soon as you are and so you must provide additional value).

You should try to get a regular (perhaps twice a year) slot on the agenda for the senior management team meeting to provide a competitive update. This should be strategic in nature and focus on the changing competitive landscape as well as insights from activities such as your win-loss programme.

Once you have established your team’s credibility for providing strategic insight, you are likely to receive one-off requests from executives for research and analysis. This in turn will likely require a different communications strategy – perhaps an in-depth report (but confirm with your stakeholder what they are expecting before you produce anything.)

Product Management and Marketing

These are two important groups of stakeholders and as well as receiving your regular email / newsletter I would recommend meeting with each every quarter. These meetings should be two-way with you conveying the latest Competitive Intelligence on topics relevant to each group while hearing from them what they would like from your team.

It is likely that the product group in particular will also have some useful insights that they have picked up while talking to customers and partners but probably did not think to pass on during the course of normal business.

No matter how comprehensive and timely your data collection, or how good your evaluation of that data, unless you have a well-executed dissemination plan for each of your stakeholder groups, your efforts will have been wasted