Competitive Intelligence – Collection

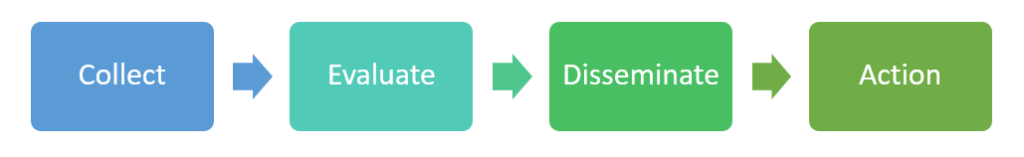

In my previous post, I gave a brief introduction to the topic of Competitive Intelligence (CI). In this one, I will look at the first component of the four-step CI process – Collection.

In many ways, the evolution of the World Wide Web over the past 25 years has made the collection of competitive data much easier. A lot more information is freely available and there are a host of tools, from Google Alerts to full-blown CI applications, that can automate the capture of data. However, the proliferation and ease of capture creates a new problem for the CI professional: it is now all too easy to be overwhelmed by the volume of data and make the next step – Evaluation – that much more difficult. Remember that raw data is of no value until it has been evaluated and communicated to the relevant stakeholders.

Collection is not a one-time process. Yes, you will have to do extensive research upfront to create your initial battlecard or produce your first analysis report, but thereafter you must have an ongoing collection process to track changes in your competitive environment.

Humint v Sigint

Using an analogy from the world of military intelligence, we can distinguish between two sources of intelligence data. Human intelligence (humint) is information obtained by speaking directly with people who have knowledge of the subject, while signals intelligence (sigint) is the published, or written, information. The latter might be freely available to all, or hidden away in a private database or behind a so-called paywall. Both humint and sigint are of value. Humint in particular can give you access to unique information not available to others, but any source should be evaluated for reliability.

What to Collect

With so much data available, it is important that your collection process is focused on finding the information that will help to deliver on the objectives of your CI programme, whether that is helping your sales team beat your number one competitor, or understanding broader market trends for your M&A executives.

As noted above, there is a lot of information freely available via the Web to anyone who cares to look and it is very likely that your competition will be accessing the same data, thus reducing its strategic value. So it is well worth investing time, effort, and money to find and access the more hidden data.

Whilst being selective is important, the most effective CI practitioners also understand the value of serendipity and will constantly scan for possible connections and insights.

Examples of Sources of Relevant Data

There are too many possible sources to discuss them all in this article and so I have picked a few of the more important, focussed on competitors (although many will be equally applicable to other entities such as partners, customers, and suppliers that you should be watching).

Company Websites

You will find large quantities of valuable information on the websites of your competitors, but this does come with a warning. Most of that information will have been placed there quite deliberately by the company’s marketing team in order to convey the messages that they want to be seen. This information may not reflect accurately the actual position – for example, the product announcements from software companies often tend to over-hype the capabilities and availability of the product.

Among the topics to look for on competitor websites are:

- Marketing messages

- News of customer wins and new partnerships

- Product announcements

- Leadership changes

- Financial results (for public companies)

Review Sites and Support Forums

There are a number of well-established product and employee review sites such as Capterra, Trustpilot and Glassdoor that can give useful insights into a company’s products and culture. Often the more negative reviews are of most value as they can highlight weaknesses that can be exploited in your own sales campaigns.

Support forums are sometimes publicly accessible and provide an insight into what users are really experiencing when using the product, and if moderated by the vendor, a view of how well they care for their customers.

Interviews with Former Employees

To remain ethical and to avoid an individual from violating confidentiality agreements you need to tread carefully, but if your company has recently hired employees from a competitor it is always worth having a conversation with them. One useful question is to ask them how your organization is viewed from the competitor’s perspective.

Win-Loss

In an ideal world, your CRM system should contain valuable information about how your company is doing against today’s competition – who you are winning and losing against and maybe some comments from sales reps. However, if your company is just starting out on the CI journey, the sales team will not yet be in the habit of recording this data. You should start by interviewing the reps, or better still the customers and prospects themselves in order to extract valuable insights. I will discuss setting up a win-loss programme in a future article.

Analyst Reports

In many industries, there are analyst organizations that study the market and its major players. They then use that information to advise their clients when selecting a new product or service. Normally their research reports are only available to their paying clients. However, if a vendor receives a particularly glowing review, they might purchase reprint rights to the report and make it available to their prospects and customers. It is usually possible then to obtain a copy simply by giving your email address and downloading from the vendor’s website (although some organizations will block downloads from their competitors’ domains).

Financial Information

The amount of financial information about companies that you will be able to find easily will vary significantly depending on whether they are public or private corporations, and in which country they are based. For example, in the UK all companies have to submit at least some level of annual financial report to the authorities, which then becomes publicly available, whereas in the US, only publicly traded companies have to do this. There are also organizations such as Crunchbase and PitchBook that can be a good source of data, although may require a paid subscription.

Other Sources

Among the other good sources of data are a company’s social media presence, blogs, trade shows, trade journals, conferences, consulting firms, academic papers, your partners … the list is endless.

Summary

Collecting data about your competitive environment is the vital first step in the CI process. You could never hope to capture everything and so being selective, based on your objectives, and organized are keys to success.

In a future postI will look at the Evaluation step of the CI process – the task of converting the information that you have collected into meaningful intelligence. Until then, if you have any comments, please add them to the conversation.